James Knowles, Head of Commercial Projects, Drapers

The only consistent thing in fashion retailing is change. Today retailers find themselves being led by, rather than leading, the consumer, who dictates how they want to browse, buy, receive and return.

Stores have been reconfigured, websites are constantly updated to become more user friendly, social and personalised strategies have been developed, and that all too critical final mile is adapting too. However, there is work to do.

You might be meeting customer expectations now, but are you looking ahead and asking ‘how will I meet those needs tomorrow?’ Adaptability is key, but change takes investment and crucially, that most precious resource, time. So understanding where the market is headed is critical.

Drapers exclusive report, Delivery and returns: Are you meeting customer expectations?, in association with Electio and On the dot, aims to identify some of the business critical trends you need to know about.

Look no further than the rise in demand for same day delivery. With competition rife, can you afford not to offer it?

Similarly, personalisation strategies have come right to the fore in fashion retail, so why does the delivery and returns end of the transaction lag behind? Personalised deliveries, appropriate to people’s location and working hours, could become a key differentiator and advantage in winning share of wallet.

Click-and-collect, one of the big retail success stories of the past few years is also adapting. The likes of Tesco and John Lewis now charge for the service, while etailers such as Asos and Missguided are using Asda’s store network via its ‘toyou’ service. This all suggests that the market will continue towards convenience, but in a more sustainable way.

And are retailers missing a trick when it comes to maximising opportunities with branded delivery and returns communications? A bad delivery or returns experience is seldom associated with a carrier, so this will require a razor like focus from retailers.

Where efforts are being made to make deliveries more convenient, shouldn’t the returns process be just as easy, just as seamless? The challenge is making this happen while protecting margins.

And finally, with consumers more ethically aware than ever before, should retailers be thinking ahead towards more sustainable packaging, and then building that into their sales story?

Clearly, there are lots of questions but also some very valid areas to consider for investment.

We hope you enjoy this report and we would love to hear your feedback.

DELIVERING THE ‘SAME DAY’ PROMISE

Consumer demand for immediacy and convenience are driving retailers’ final-mile propositions, but what does this mean operationally? Hywel Roberts reports.

The speed at which consumers expect their goods to be delivered is increasing at an alarming rate for some retailers. You can forgive some logistics managers and partners for being a little frazzled trying to keep up.

A same-day guarantee is the next target retailers are either working towards or have achieved. And like most retail innovations, it is driven by the wishes of the customer.

Patrick Gallagher, chief executive of delivery service On the dot, says it has got to the point where retailers “must consider the cost of not offering convenience to customers”.

“Consumer expectations of convenience are transforming the retail landscape. Time is a precious commodity and people are more than ever attracted to the brands, products and services which make their lives easier. Basket abandonment is a serious issue for retailers, but inflexibility with delivery options could not only cost the value of an abandoned basket, but also decrease customer loyalty. Giving consumers the power and opportunity to select the kind of delivery that suits them best is fundamental to providing stellar customer experience in our ‘always on’ retail landscape,” he explains.

With retail being such a broad church, it is no surprise that vendors are at very different stages in their journey toward offering the same-day guarantee. At the top end, things are moving rapidly and technology that matches anything seen in comparative sectors is being mooted, says British Retail Consortium (BRC) senior external affairs advisor Bryan Johnston.

“We have clients who are looking at driverless cars and drone technology to match the ever-increasing demands of consumers’ delivery expectations,” he explains. “The technology itself isn’t far away, but the main hurdles are going to come in the form of regulations around airspace and so on. So how feasible that high-tech approach will be remains to be seen.”

As exciting as it is to think about this airborne future for fashion items, the vast majority of retailers are currently having to keep their feet firmly on the ground when looking to speed up their deliveries. One of the most advanced in its offering is House of Fraser, which offers a £6 same-day delivery option for items ordered before noon.

A spokesman for the retailer told Drapers that offering options such as this makes up part of a holistic approach dictated by “the growing interaction between online and offline retailing and increasing use of digital services”.

The aim is to “provide a unique shopping experience, covering the entire journey from search and browsing all the way through to purchase, delivery and customer service. Ultimately, the winners will be the retailers who really understand their customers and prioritise that relationship.”

But although retailers such as House of Fraser are already in a position to provide same-day guarantees, some smaller and younger retailers may not be there yet. One example is etailer PrettyLittleThing. Despite being a fairly well-established fashion brand, it does not currently offer a same-day delivery option. But this is “something we are reviewing”, says logistics manager Ben Hulme.

“The way delivery options are developing, we wouldn’t be surprised to see same-day delivery as being the norm in the UK, and next-day propositions internationally,” he adds.

And Hulme believes there are financial rewards for those who do this well: “Brands can reap return on investment rewards due to the increase in purchases as a result of the later cut off for the customer.”

Risk and reward

Introducing a same-day delivery guarantee from scratch can be a high-risk financial decision. So, many retailers opt for a soft launch before fully committing. One company taking this approach is babywear brand Mori, an ethical online clothes subscription service that relies heavily on its delivery offer.

“We have tested a successful same-day and three-hour delivery service in London, which we hope to roll out long-term soon,” explains co-founder Cam Miller.

Gallagher says consumers will pay for more convenient deliveries. “Earlier this year, On the dot conducted a survey together with YouGov to look into the consumer opinions at play here. We found that customers are not only willing to pay for convenience, but that the average customer will actually spend up to a staggering six times more for a delivery option that best suits them.”

But even though we are not at a stage where everyone can offer same-day delivery here in the UK, we are certainly in a better position than many other developed markets.

Julia Bosch, co-founder and CEO of online German menswear retailer Outfittery, says the UK “is way ahead” of comparative European markets: “Customers here are only just starting to experience options such as same-day delivery, so it’s not something they necessarily crave or expect yet.”

The expectation is there in the UK, however.

Gallagher concludes: “Retailers must reflect this shift in all aspects of their offer or risk being outmanoeuvred by competitors. As the final touchpoint between brand and customer, delivery is one of the most powerful ways to introduce new levels of speed and convenience. In short, the ‘sorry we missed you card’ needs to be consigned to the flames of retail history.”

The growing demand for same day delivery:

78% of customers want same day delivery when shopping

53% of consumers would only pay extra for delivery if offered a same day guarantee

Customers are willing to pay up to six times for for delivery if it’s on the same day

10% of UK retailers offered same day delivery in 2015 up from 4% in 2010

50% of consumers have abandoned an online basket due to unsatisfactory delivery options

Sources: On the dot/YouGov consumer convenience survey; statista.com, econsultancy.com

DRIVING SALES WITH DYNAMIC DELIVERY

If personalisation strategies are being driven by relevance, shouldn’t retailers also only be showing the consumer the most relevant delivery options depending on when and where they are ordering, and when they want their parcel by? Hywel Roberts investigates.

There is no doubt that speed of delivery is one of the biggest factors when attracting new customers and inspiring loyalty among existing shoppers. But promises such as the same-day guarantee are not the only way to stand out from competitors.

Personalised and dynamic options when offering delivery choices are rapidly becoming an important second front in the battle for online custom. But beyond the buzzwords, what does this really mean?

“Currently, only the most progressive retailers are looking at the checkout experience, and it’s a wise move. Delivery options are getting more and more cluttered; retailers making their checkouts smarter and more personalised has the potential to be really lucrative. Dynamic, personalised delivery options are the future,” explains Andrew Hill, commercial director of delivery management platform Electio.

“For example, if a customer orders something online on a Friday night, it might be totally impossible for them to receive it before 10am the following morning if they live far away. Yet this option might still appear in the checkout, and the customer will end up being let down. Surely it’s much better for your brand to offer bespoke delivery choices to suit the lives and locations of each of your customers? They are far more likely to keep on coming back if they know you can fulfil your promises.”

Interactive Media in Retail Group (IMRG) head of e-logistics Andrew Starkey agrees that it is still only a small number of retailers who are offering these services. And even when they do, poor communication of the offer means many consumers do not feel confident enough to use the specialised delivery services provided.

“At the moment, less than 1% of transactions made online involve this kind of specialised delivery option,” he says.

And Starkey believes this is largely due to a lack of information available to customers before reaching the point of sale: “The main thing consumers want, especially with fashion retailers, is to know their options before they get to the checkout screen. Shoppers really value that and if they get it early what you see is a large drop in abandonments of shopping baskets before they get to payment. The leading retailers like Asos and John Lewis are now offering different options on specific items on their website.”

The wisdom of this is supported by the figures, says Starkey. The 2016 IMRG/Blackbay Home Delivery Review reports that around a third of shoppers check delivery and return information before they pick a retailer.

Make it personal

Retailer New Look is now offering its customers a more personalised delivery service in the form of timed slots that offer greater convenience. The retailer told Drapers this kind of offering shouldn’t be seen as a separate option for customers, but as an add-on to what is currently available.

Under the new system, customers will be able to pick an hour slot between 11am and 5pm on any of the seven days following purchase. This is included in the next-day or nominated-day delivery price of £5.99.

“The introduction is simply about customer satisfaction,” a representative says. “The more choice and convenience customers have over their deliveries, the greater satisfaction they have. We are not launching this as an additional service to our customers – this will be our standard next-day and nominated-day offering. But for online or offline orders customers will be able to choose a one hour-delivery window.”

As discussed, dynamic delivery starts well before the point of purchase. But the retailer’s duty doesn’t end when the money has changed hands. Etailer Avenue32.com focuses very much on the post-purchase service it offers.

“Our delivery service allows customers to track their orders online and through text message updates; redirect their orders in transit; leave delivery instructions to drivers as well as specify Saturday and Sunday deliveries,” explains commercial director John Brien.

“As a luxury brand, we always seek to preserve the direct contact and intimacy with our customers.”

While all retailers are keen to offer this, clearly restrictions on time and resources limit what some of the newer players can do compared with the big guns.

This is something that global womenswear brand Izabel London founder and director Karan Singh Uppal hopes will change in the future: “I’m currently not happy with what we are practically able to deliver,” he says. “But I think what we’ll see is the advent of driverless cars and drones comes along and level the playing field with the bigger companies.

“We’ve got to a point now in ecommerce where delivery is almost the whole thing. You can often find the same item from six different retailers, so how you can deliver will make the difference between a sale and the customer going elsewhere.”

With that message ringing in fashion retailers’ ears, it is surely only a matter of time until these advanced options will be rolled out more broadly. In ecommerce, failing to deliver, and deliver well, really could be disastrous. Speed is always going to be important, but offering personalisation and choice to the customer as early in the buying process as possible will be what really keeps consumers coming back for more.

WHAT’S NEXT FOR CLICK-AND-COLLECT?

Click-and-collect has been one of the big retail success stories from the high street over the past couple of years, and now the market is continuing to evolve. Hywel Roberts find out what the future of click-and-collect looks like.

Since the advent of click-and-collect around 15 years ago, it has gone from strength to strength – a recent Drapers consumer survey found that more than 50% of British shoppers have used the service

But a YouGov report earlier this year unearthed some issues with click-and-collect over the Christmas 2015 period. A poll of consumers found only 24% said they were likely to increase their click-and-collect usage in 2016 amid complaints about long waits and breakdowns in the process.

Jason Shorrock, vice president retail at supply chain and retail operations specialists JDA told Drapers: “It’s worrying that Christmas exposed cracks in their click-and-collect operations. Without the effective management of staff, stores and inventory, retailers risk damaging customer relationships.”

But that doesn’t mean demand for click-and-collect is on the wane.

“Click-and-collect has shown very consistent growth for each of the past four years,” says Paddy Earnshaw, chief marketing officer at delivery company Doddle.

“This is good for a couple of reasons: first, it drives great footfall and second, because there’s a shedload of product making its way to the stores anyway, so it’s pretty cost-effective.”

One of the biggest ways click-and-collect is evolving is collaboration between etailers and bricks-and-mortar stores to provide collection points for online sellers that would otherwise not be able to offer the service.

The biggest example of this is supermarket chain Asda’s “toyou” service, launched in November 2015. Customers can collect items from a number of online retail partners, including Missguided and Asos, from one of 614 Asda stores.

The concept brings benefits both to the online and physical retailers, and Asda’s parent company Walmart hopes the service will attract 40m customers to its stores by 2019.

This will go some way to resolving the conflict between online and offline retail, says Ian Stansfield, Asda’s vice president logistics, services and supply chain: “Not only are we providing online retailers with a presence on the high street, we’re also bridging a gap for customers who want to collect or return their online orders while carrying out their weekly shop.”

Smaller online businesses are also taking advantage of the opportunity to partner with the high street. Men’s personal styling website Thread.com recently launched its own click-and-collect service, which allows consumers to collect from a number of local Collect+ convenience stores within the M25.

Co-founder and CEO Kieran O’Neill says it is bringing in retailing gains even he had not considered: “What we’re seeing is people from remote locations who wouldn’t before have ordered suddenly being able to shop on the site,” he explains. “And that’s clearly a big advantage both for us and the customer.”

Jigsaw chief operating officer Richard Gilmore believes that for retailers in 2016 “click-and-collect is just a given”. But he reveals that Jigsaw is also looking at ways to take the service to the next level.

“The next stage for us – which is currently in development – is order fulfilment from stores if we sell out online,” he says. “It’s a way to use the service not only to satisfy online shoppers, but to support our whole omnichannel business.”

However, one trend that has come to the fore over the past year is large retailers who previously offered click-and-collect for free starting to charge for the service. Tesco announced in February that it would charge £2 for orders under £30. And at John Lewis an identical charge came into force in July.

Discussing the charge, John Lewis managing director Andy Street said: “We are sure customers will understand why we are doing this. There is a huge logistical operation behind this system and quite frankly it’s unsustainable.”

Click-and-collect seems to have a secure future. But it has not all been plain sailing. Customers may have to be prepared for further price hikes in some cases, but for their money they can reasonably hope for faster services that cover more of the country. For many, that will be a trade-off they are willing to make.

Click-and-collect: How does the competition stack up?

House of Fraser: Free next-day delivery for orders placed before midnight

John Lewis: Free for orders of more than £30, rising to £2 for orders of less than £30. Order before 8pm for delivery after 2pm the next day.

Missguided: Costs £1.99. Order before 8pm for delivery the next working day from collection partners including Asda.

Topshop: Express option of collection from store after 1pm the next day when you order by 9pm weekdays or 5pm Sunday costs £3. Free standard option for collection from store between three and seven working days after placing order.

Marks & Spencer: Free. Order by 8pm for 12pm next day delivery.

Uniqlo: Free for orders more than £19.90; £2.95 for orders less than that. Order before midnight to collect before 12pm next day.

Very.co.uk: Free. Order before midnight for next day delivery to one of 4,500 local shops in UK. Option to choose time slot.

Asos: £5.95 for next-day collection if ordered before 6pm. Free standard service within five working days.

Next: Free. Order before midnight for next-day delivery.

Debenhams: Free. Order by 9pm for 12pm next-day collection.

Jigsaw: Free. Next working day delivery if ordered before 4pm or inside M25, otherwise two to five working days.

COMMUNICATIONS – THE MISSING PIECE OF THE PUZZLE?

There has been a lot of investment in offering a suite of delivery options, around a quicker and more convenient service, but are retailers really owning the communications space? Nicola Smith finds out.

Fashion retailers have been quick to expand the choice of delivery options on offer, but are they missing a trick when it comes to owning the communications space and improving the brand experience?

Professional services firm KPMG’s Omnichannel Retail Survey 2016, pulished in February this year, found that online order tracking is offered by 70% of retailers. However, fewer than half – 49% – of customers are able to track their order directly through store websites. Of the remainder, 28% were able to through a third party, while 23% were not able to track their order at all.

Precision retailing

This summer Asos and New Look began to allow consumers to choose a one-hour time slot between 11am and 5pm for delivery within the seven days following purchase.

For New Look it is one of several additions to its suite of delivery options in the last two years, including seven-day-a-week delivery. Importantly, customers can track their orders on the New Look website or directly via the links provided to them from the courier.

“We work with our couriers wherever possible to ensure communication is New Look branded, and the wording and tracking information is as clear as possible,” says a New Look spokesperson. But it is a work in progress. “It is an ever-evolving process, as many tracking systems were previously designed for business-to-business customers.”

Delivery is an area in which portal for independents Farfetch has also invested in the last two years. It launched a global click-and-collect – and returns – service in November 2014.

“Customers can now buy from a boutique in Paris and pick the item up from a store in London,” says Andrew Robb, chief operating officer. It has also launched same-day delivery in nine cities worldwide, as well as undergoing a trial with click-and-collect provider Doddle to increase its number of pick-up points in the UK.

Data access

While the delivery options are cutting edge, Robb says the company is still working on improving its communications in this area: “The bulk of our orders are completed through DHL, so if a customer wants to know the status of their order, they can go via the order section on Farfetch to the DHL site to find out.”

Customers also receive an email with a link to DHL’s tracking facility.

“It works but it isn’t a super-slick customer experience. We‘d like to make it a lot easier for customers to get that information on site, and give them more regular and proactive updates.”

For footwear retailer Schuh, whose options include seven-day-a-week delivery and a click-and-collect service in a minimum of 20 minutes, all its parcels can be tracked online, and it errs on the side of providing too much information.

“In our email and text communications we make promises we know we can keep – dates, times etc – so they can feel confident,” says Sean McKee, head of ecommerce and customer service at Schuh. “We probably over-communicate on email but we would rather do that and know the customer is in an informed place in their journey.”

It is a savvy approach.

As Andrew Hill, commercial director of retail delivery management platform Electio explains, good communications not only provide an opportunity to enhance the brand experience and foster loyalty, it also impacts on the bottom line: “There is something called a ‘WISMO’ call – where is my order? On average it costs a retailer £2.50 to answer a WISMO call. If you don’t get your communications right, as you grow, you will exponentially increase the number of these calls. At £2.50 a call, that really adds up.”

It is an area of which Robb is acutely aware, despite believing that any interaction with the customer should be viewed as an opportunity to build a relationship: “In some countries customers prefer to call, but on the whole these are unnecessary customer service interactions, for the customer and for us.”

Post-delivery intelligence

Delivery choices are increasingly seen by consumers as an extension of a brand. The ability to keep up with growing demand, both in terms of volume and for convenience, could make or break a retailer in what is a viciously competitive market. Schuh deploys both email and text surveys to gain feedback.

McKee says: “As a principle, this needs to not disrupt the journey but is asked in a natural place at the end.”

New Look also uses post-purchase surveys, sharing the data - as well as customer comments - with couriers on a monthly basis to constantly improve service, while Farfetch’s follow-up email survey prompts thousands of responses each week. “That information is ultra-powerful,” says Robb. “We can often identify quite quick areas to address as a result.”

As fashion retailers continue to offer increasingly nuanced delivery options, so the opportunities to communicate with customers grow both more complex and more pressing. Hill believes it is an area which is moving up the agenda for most brands, there is still work to do.

Etailer Asos is working on ways to make the tracking of delivery even simpler and more consistent to its brand - mooting push notifications and visual updates for its app users – while Farfetch is striving to offer ever more accurate delivery estimates to its international client base. “Ultimately, we want to make it as fast and easy to get customers the information they care about,” says Robb. Simple.

REDEFINING RETURNS STRATEGIES

Returns are an integral part of any ecommerce operation, and retailers have to balance customer convenience with cost and efficiency. Petah Marian reports.

For pureplay online retailers or those with a significant digital sales component, returns are an inevitable part of doing business.

As retailers compete for market share online amid a difficult consumer environment, they are largely focused more on ensuring the ease of experience for customers who wish to return products.

A survey by Savvy Marketing of more than 1,000 UK online shoppers who bought women’s clothing in the six months to May 2016 found that about two-thirds had returned at least one item.

“When a consumer shops in a bricks-and-mortar store, they might take five items into the changing room. You wouldn’t ask them to make up their mind on what they want to purchase before they go into the changing room,” says Jan Bartels, vice-president of product logistics at international German etailer Zalando.

Given that returns represent such an important part of the customer experience, retailers need to ensure the smooth running of the process.

Asos brand experience director Eve Williams says: “It should feel like a delightful experience to return something. Not requiring you to go out of your way, stand in a queue or print something out. That’s always our primary focus: how do we make the process as easy as possible for the customers? It’s already disappointing should you receive a product that is just not quite right, and we wouldn’t want to make the return experience disappointing, too.”

She adds: “We want to get the product back as quickly and smoothly as possible so we can send them any replacements and give confidence in how smooth the experience is.”

Returns are becoming increasingly important as retailers compete on convenience.

Online retailers are testing ways to take friction out of the returns process. Zalando is trialling hour-long returns slots in partnership with On the dot, whereby a courier picks up returns within 60 minutes of the shopper booking the return, or at a scheduled 60-minute window.

But convenience comes at a cost. Professional services firm KPMG estimates that to pick and deliver an order costs between £3 and £10, but it can cost double or treble that to process the return.

Bartels believes Zalando’s ability to offer the customer choice is down to its efficiency: “We have optimised our processes over the last few years and now have a really efficient returns process in the warehouse.”

Retailers also have to reduce the amount of time an item is “off the shelf” to minimise markdown and maximise margin, in a cost-efficient way, says Sue Butler, director of management consultancy Kurt Salmon.

Around £600m of products bought over the 2015 discounting weekend between Black Friday and Cyber Monday in the UK were tied up in return loops by the middle of December, reports software provider Clear Returns.

But services that add convenience for the customer are also helping the logistics of product returns. Delivery provider Doddle, for example, consolidates online returns for retailers, reducing logistics costs while also getting inventory back into stock faster.

“When consumers use post or other services to return goods, retailers get them back in a piecemeal way,” explains Doddle chief operating officer Peter Louden. “The volumes we deal in mean that retailers can feel confident items will be returned quickly. If you’re a retailer processing 100,000 returns in a day, that can be significant.”

There has been talk among delivery providers of extending these types of services into returns-processing portals. But these kinds of shared services have their limitations for larger retailers. Zalando’s Bartels says it is happy to use shared returns services for collection, as a means to improve convenience for customers, but its scale means that it’s better to have returns processed in one centre, where it can retain control of what can be resold and manage logistics processes at scale.

For smaller retailers efficiencies of scale take another form.

On the dot CEO Patrick Gallagher believes “smaller independent businesses can benefit hugely from collaboration. We know that partnerships enable retailers to offer competitive services, boost operational efficiencies and allow them to focus on their strengths.”

This is no different when it comes to returns: “By working together and outsourcing services to specialised providers, such as On the dot, retailers can not only offer a better overall experience for their customers but simultaneously maximise efficiency and minimise costs”.

Most multichannel retailers and pureplay etailers plan to increase the proportion of sales they make online. As returns are an integral part of the ecommerce, increasing efficiency and reducing cost will be high on everyone’s agenda.

GETTING SUSTAINABILITY WRAPPED UP

Packaging for online orders should be functional and durable – but also needs to minimise an etailer’s environmental footprint. Kathryn Bishop explains how.

For pureplay online fashion retailers is it essential that their packaging is functional, durable and cost effective. Today there is an additional consideration: sustainability.

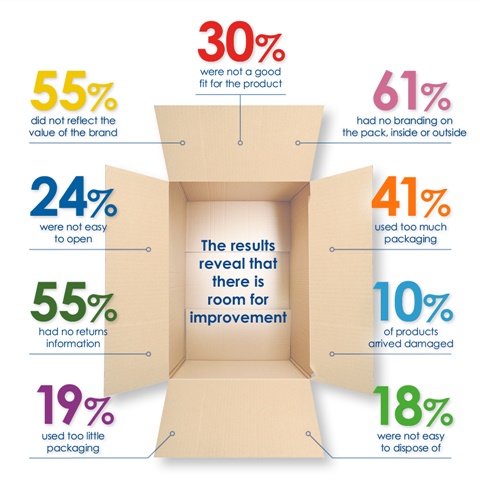

A study across several industries by Macfarlane Packaging published in June 2016 highlighted concerns about the condition of online orders on arrival. It found that 41% of respondents said items were sent with too much packaging, 18% found the packaging difficult to dispose of, and 55% felt it failed to uphold the value of the brand or company.

Meanwhile, consumers are increasingly aware of the environmental impact of their purchases. A 2015 study by research company Nielsen of 30,000 consumers in 60 countries revealed that a brand’s commitment to the environment has the power to sway the likelihood of a purchase for 45% of consumers.

As scale of distribution of online orders grows, online retailers are under pressure to try to reduce the environmental impact of their online order packaging – as required by their corporate social responsibility commitments. Aside from the volume, type and durability of the packaging needed for home delivery and returns, they are also concerned with the potential waste produced by each order. Consequently, CSR action plans and changes to online order packaging are being put into force.

Next announced in its 2015 Corporate Responsibility Report: “We believe there is opportunity to reduce the amount of waste produced, for both ourselves and our customers, by reviewing the amount of packaging used on our products, reducing it where possible to ensure it is the right size, and improving the recyclability too.”

Similarly Marks & Spencer – known for its Plan A sustainability drive – achieved its target to reduce the weight of delivery packaging by 25% in 2015 by minimising the amount of wrapping used for individual items within each parcel. As a result, its average online orders require about 92g of packaging, down by 60% against the 2008/9 baseline of 230g per parcel average.

Arcadia Group’s Fashion Footprint programme launched in 2006 and plans, monitors and manages the social and environmental impact of its business. A spokesman for the company says that through this, reductions have been made to the thickness of its three types of packaging bag, and the design, which now incorporates a handle to make it easier for customers to carry home from a collection or delivery location. Its packaging is also reusable for returns.

Arcadia Group’s spokeswoman states the company is “proud to source from the UK, which substantially reduces our delivery mileage carbon footprint”, and Arcadia encourages its distribution centres to pack multiple items in each package.

Equally running with reusability and returns in mind, German etailer Zalando notes that 90% of its boxed returns require no additional tape, thanks to an integrated adhesive closure. A spokeswoman told Drapers it is also heavily focused on using recycled materials – for example, its cardboard packaging consists of 95% recycled materials and uses a plant starch glue.

At the beginning of the supply chain are the packaging companies, who work closely with online fashion and lifestyle retailers to ensure their packaging is sustainable and reaches environmental goals, without impacting processes and productivity.

“Environmental goals differ, depending on the brand’s goals, whether reducing waste to landfill, reducing carbon footprint, encouraging customers to re-use packaging, or reducing the volume of packaging used to distribute their products,” says Zoe Brimelow, brand director for packaging company Duo UK. She adds that a defined environmental target or focus and a team engagement plan often attribute to goals being achieved.

One such goal, as Zalando and Arcadia have exemplified, is the streamlining of packaging to best fit with the product being shipped.

“We know that consumers do not like to receive parcels that contain excess packaging or receive packaging that is not easy to dispose of,” says Macfarlane Packaging marketing director Laurel Granville. “There are millions of unboxing videos on YouTube alone that will tell you what consumers think about excess packaging.”

And with online shoppers lacking access to a changing room to try before they buy, shipping material also needs to stand the durability test if it is to be used for returns and avoid additional waste or new packaging.

“Fashion consumers expect an easy returns service and retailers also have an opportunity to provide return-ready packaging, cutting down on the packaging used and ensuring that the retailer’s goods arrive back at their store or depot intact,” Granville adds.

What is more, packaging can be a canvas for companies to communicate messages about their sustainable practices and recycling information.

“Sustainable packaging goes way beyond functionality – it allows the consumer to feel empowered to take action and shapes the way consumers buy products,” says Keenpac’s retail channel director, Cara Jeffrey. “Clear communication and labelling on the packaging is key to delivering the right message to the consumer to keep them informed on the benefits and how to dispose of the packaging.”

By way of an example, online order packaging for award-winning ethical fashion label Rapanui proudly displays that it is made from plant-based materials and the bags themselves are entirely recyclable.

Duo UK’s Brimelow says: “Key innovations in the packaging industry are those that don’t pollute the waste stream and [are] easy innovations for companies to adopt. The environment is an emotive topic that can create deeper, loyal relationships between consumers and brands [see box, below].”

Keenpac’s Jeffrey adds: “The reusable bag category is delivering some interesting innovations with the use of bamboo, Tyvek, recycled PET and Global Organic Standard (GOTS) certified cotton, each with its own environmental benefits and considerations. Ultimately, good overall product design is key for delivering sustainable online packaging, by bringing together the materials and functionality of the product with a sustainable supply chain.”

Latest innovations in sustainable packaging

GreenPE A sustainable alternative to oil-based polythene, created from sugar cane, can be manufactured in the same way as polythene and is 100% sustainable, 100% renewable and 100% recyclable.

Recycled PET Made from recyclable plastics such as bottles, this PET packaging reduces a company’s carbon footprint, saves natural resources, and lessens landfill waste and the incineration of plastic.

Tyvek A durable material that combines the physical properties of paper, film and fabric, made with 100% polythene. Used for mailing envelopes, it is water resistant and tough, and provides a longer shelf life and better appearance over time.

Bamboo Used for packaging and containers for wrapping fashion items by brands such a menswear label Lyme Terrace, which packages products such as its bamboo fabric T-shirts in tubes of bamboo.

PARTNER COMMENT

Drapers report partners, Electio and On the dot, share their views on the trends shaping the delivery and returns market.

Andrew Hill, commercial director, Electio

The pace of change in ecommerce, particularly with delivery options and returns policies, is staggering. Thanks in large part to Amazon, customer expectations have been transformed in recent years; retailers need to adapt, fast, if they want to seriously compete.

Whether it’s next-day, timed or same-day delivery, speed, convenience and cost are all factors that influence delivery choices. But with basket abandonments now reaching 73%, customers are still facing expensive or inappropriate delivery options that don’t suit their personal preferences. Retailers managing multiple carriers in order to meet consumers’ needs is where new generation delivery management technology comes into its own.

But what next for the industry? We’re already seeing same-day options growing. But it’s not just speed that is influencing developments. Before we see flocks of drones taking to the skies, I see the main evolution happening with click and collect. Retailers sharing space, such as Asda offering the toyou service for third party brands, including Missguided, will be the next major trend to offer consumers the convenience they crave.

This thirst for convenience also stretches to returns. Consumers now expect just as much choice in how they return items as they do from how they receive them. Retailers embracing the concept of returns as a behaviour of loyal customers, as opposed to being a thorn in their side, is another major trend we’ll see in the coming months.

Finally, car boot delivery is another concept seeing trials this autumn that will attempt to deliver convenience. But changing customer willingness to entrust a delivery company with this responsibility may be a stumbling block. Peer-to-peer and even driverless car delivery are models also being trialled and in fact may not be as far away as many in the industry might think.

Patrick Gallagher, CEO of On the dot, a CitySprint brand

Today’s generation of consumers are the most demanding yet. They are tech-savvy, constantly connected, opinionated and they like things on their own terms. For these millennial customers, there is no distinction between online and offline – they expect their retail experience to be seamless and personalised, regardless of where they are shopping.

This change means a lot for fashion retailers. With high street footfall at its lowest level since 2014, solely relying on a bricks and mortar strategy is no longer sufficient when it comes to keeping pace in the evolving retail industry. Retailers need to make sure that their ecommerce offering is complementing, not competing with their store presence, offering a consistent customer experience at all times. And with delivery being the only face-to-face touchpoint during the ecommerce journey, it is crucial that a good experience during the purchasing journey does not fall short at the last hurdle.

Recently, we have seen a significant move from a delivery-last model, to retailers starting to use delivery as a way to differentiate from their competitors, offering the ultimate customer experience. Delivery should no longer be on the retailer or carriers’ terms, but determined by what is most convenient for the customer. In short – the days of missed deliveries should soon be over. Deliveries should be convenient, personalised and transparent, ultimately putting the customer in control.

The same can also be said for fashion returns. With 1 in 5 customers returning fashion purchases, the spotlight is also on retailers to improve their reverse logistics and further enhance their customer experience.

Delighting today’s shoppers is no mean feat, but retailers who transform their delivery and returns processes - with convenience at the heart - are those who will have the most success.